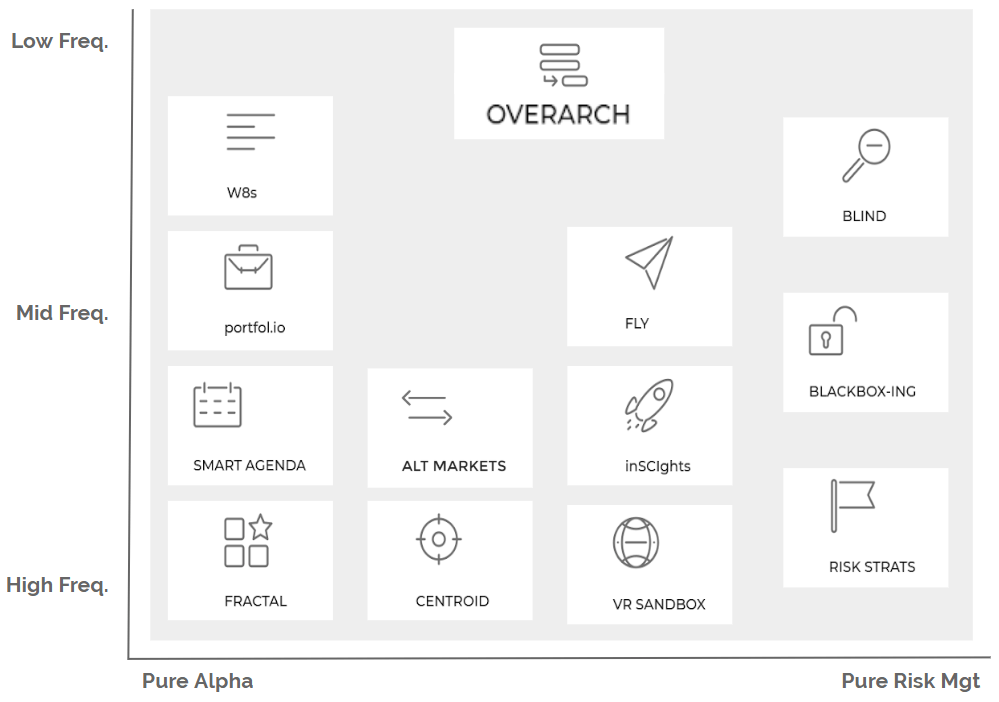

· SW'S APPS AND SERVICES ·

SW was conceived with a clear purpose: to help deal with algorithmic transformation from all possible perspectives - tech, roles, training, game theory, tactical & strategic solutions

SW was conceived with a clear purpose: to help deal with algorithmic transformation from all possible perspectives - tech, roles, training, game theory, tactical & strategic solutions

"Our core advantage is our focused seed. We created SW because we wanted to move fast. Faster than we did while working at highly regarded incumbents. By simply focusing and freeing-up ourselves from their legacies we evolved at 10x the speed".

Marta Díez-Fernández, CEO.

SW's founders have a professional broad experience working at different global banks, all tier one, whether retail or investment. Additionally, they account for academic recognition. Than allowed SW start taking over the first projects on algorithmic transformation and build up a unique expertise around industry best practices to unlock innovation. Such dual experience is unique.

Crucially, such judgement is accompanied by proprietary technology - a very special one that allows blending products and services to create further ones at high deployment turnaround. SW's clients can hence tackle algorithmic transformation in a privileged way, bespoke and from scratch.

Highly fine-tunable Algo Trading engine core for portfolio managers and traders to materialize their complex ideas with or without the data scientists' help - it all starts with their views to be enhanced with Machine Learning models. No coding skills required. Focused on non-latency sensitive strategies. Starting from the expert's views. Capable to onboard latency-sensitive ones. It reaches execution, market making and prop trading. Seamless integration with most trading buses, brokers and data providers - i.e. easy onboarding whether fully aaS or hybrid.

Adapted to group needs through platform versions upon which the rest of Apps are onboarded:

FRACTAL 101 ®: retail and family office managers

FRACTAL PRO ®: traders

FRACTAL PORTFOLIO MGR ®: asset managers

FRACTAL MKT MAKER ®: market makers

IMPROVED VERSION OF THE DESIGN PRIZED AS THE BEST TRADING PLATFORM IN EUROPE

- BANKING TECHNOLOGY AWARDS 2016

A.I.-driven, trading and risk, proprietary indicators. Any party's IP - whether our client's model, ours or even our own competitors' (we see them as partners here). Any type of asset: equities, fixed income, commodities, currencies and cryptocurrencies. Any type of data: quotes, geo-localized/imaginary, social... Whether their signals lead to high frequency quotes dynamics or a mere email/report.

Currently, trading floors require a suite of state-of-the-art strategies, in the shape of a Central Risk Book. This piece, scans all flow coming in and out of the books (whether occurring or expected) and eventually takes it to benefit from uncorrelated hedges across desks (and assets) or to reduce market footprint in execution (crucial to give a tier one service to large clients).

The elements in a portfolio can be based on a broad set of facts from standard and alternative data - whether from structured or unstructured data. And we do not settle for that - we further allow our clients to filter by:

a) Signals: ours, theirs or those of 3rd partyies - from traditional ones to algorithmic (inherited from SW inSCIghts ®);

b) Simulation: same portfolio construction upon scenarios generated with SW FLY ®.

On the fly macro simulations. Smart shortcut to allow many scenarios views, before committing to trading a portfolio - not as precise as those produced by our SW VR SANDBOX ® but handy enough for most mid and low frequency trading.

It leverages Big Data along with Online Machine Learning.

Portfolio weights based on our free samples (from equal weight to percentage of volume), our proprietary methodologies (e.g. black swan), our clients' own methodologies (DIY) or a 3rd party's. Whether static/passive or dynamic/active (considering benefits vs market impact and costs). Whether on a basic Backtest or within our SW VR Sandbox for you to control all the range of risks from low frequency trading to intraday. Start orthogonal strategies by mixing it with SW FRACTAL's capabilities.

Backtesting is not realistic. First, the capricious past is just one of the myriad of instances that could have happened, hence it is not that relevant by itself. Second, it assumes that the rest of agents would not react to one's actions.

We account for an advanced trading platform that is state-of-the-art. Upon it, advanced agents can be realisitically simulated - surpassing Academia theoretical limitations. By letting a trader design the distribution of agents in a market, we give her control on the calibration of her strategies. Similarly, risk managers can take control of stressed scenarios for testing and auditing.

Moreover, it is a tool to boost the training of traders, data scientists and risk managers in this otherwise complex and expensive, area of Algorithmic Trading.

BEST INNOVATION IN SIMULATION

- COGX 2020

The accuracy of the Sales Team (Global Markets & Asset Management) and the Bankers (retail, SMEs and corporations) can be enhanced by letting them timely react to the myriad of high-to-mid frequency signals that we provide.

Standard Recommender systems inherited from other domains can be enhanced through SW OVERARCH ® unlocking consitent reactions across departments to insightfull discoveries.

Our advanced technology of trading exchange simulation can be leveraged to systematize the way illiquid assets (from loans to real estate) are market made.

Whether centralized (public exchanges-like) or decentralized (blockchain-like).

Secondary markets can be natively included.

Our platform unlocks a whole new breed of controls and actions for each line of defense (LOD): 1, 1.5, 2 and 3. It arms risk managers with bleeding-edge trading technology - SW FRACTAL PRO ® - across assets that ultimately translates into either manual or systematic actions.

When used to improve Operational Risk, its cost can be conveniently discounted from Basel III capital requirements.

The audit of algorithmic trading is often an impossible mission for risk managers: traders want to protect their secrecy and going through all the code is not an option - hence, the algos become blackboxes. Inspired by our experience in Red Teams of Cybersecurity and crucially based on our prized SW VR SANDBOX ®, we unlock control of the risk managers by letting them create stressed yet realistic scenarios and move from the consequence to the cause of a risk to be analyzed. By running the trader's algorithm within their own set of ecosystems they can study in deep detail how the algorithm reacted to each of the agents. Unlike current stress tests based on past events, the possibilities here are infinite - which is key to avoid overfitting to past events.

Our clients make sure through this app that their data scientists comply effortless with local regulation when querying data. Additionaly, they use it to keep track of every interaction with their databases.

We constantly create synthetic data based on the different scenarios created along our calibrations and stress testings. Our clients can benefit directly from this synthetically created data instead of generating it by themselves.

A company can be subtly attacked by directly manipulating its equity and credit in the markets. It can also be gradually taken over behind the scene by active funds. We use our market expertise to track a company's dynamics and send alerts to its CFO - e.g. there is X probablility of active fund Y building up exposure on company Z.

Similarly, we track social networks to estimate whether bots or coordinated people are trying to manipulate public opinion about a company. That way, it can counter attack in a timely manner, either manually or using our own set of smart agents.

How to make the most of professionals in a world of machines? Adopt the earliest stage of Augmented Machines - the way to overcome native issues from data-drive by letting humans add value at very specific steps within Machine Learning.

Beyond the basics of Collective Knowledge, we gather the views from our clients' experts across a number of financial instruments. Those are collected by our machine and blended within her data-driven processes. In other words: SW Neocortex ® adds context.

It helps further discover those experts that are best at adding value to the machine in a near machine-driven future.

Our platform can be used as an orchestrator of tasks across portfolio managers, traders, data scientists and risk managers so that everyone feels comfortable collaborating in a digital ecosystem.

When used as a prototype platform, crucial insights can be gained before devoting large budget onto complex projects.

Digital costs can be more than halved going forward by orderly recycling code, and combining different providers within this well-thought architecture (DIY, ourselves or 3rd parties).

Due to the Equitization of the assets the adaption of SW's Finance Apps into Energy & Commodities becomes a major qualitative leap onto the frontier of Algorithmic Trading.

And, more subtly, the usage of SW's tech allows blending Energy & Commodities' signals with those from the rest of financial assets (Equities, Credit and FX).

Beware of the importance of setting the first steps of Equitization the right way. Otherwise, legacies going forward can become a burden that strangles evolution via costs, operational risk, lack of cooperation and bottlenecks.

By leveraging SW's advanced Machine Learning technology from Algorithmic Trading, upon private (IoT sensors, inventory, sales...) and public (news, market prices...) data sources, SW helps its clients improve the risk-reward ratio of their business - i.e. higher revenues, lower costs and both of them more steadily. This is, SW helps settle the right path towards the digitization of businesses.

SW's clients can anticipate:

- changes in prices of inputs (yours and those of your providers) and outputs and their consequences in your business,

- failures in inputs you have been supplied with,

- failures in operational processes,

- risks in business dynamics.

Towards a real-time system of alerts that allows you to orchestrate every piece involved in aligning all stages of your supply chain:

- better management of assets' maintenance - e.g. timings and priorities-,

- safety issues prevention,

- inventory level optimization,

- sell timing and pricing.

"We used to give Algorithmic Finance lectures to under-grads and post-grads of Computer Science at University College London. Tailoring them to practitioners has been fruitful indeed towards smooth transformation".

Sergio Álvarez-Teleña, Co-Founder.

It is crucial for employees to understand the challenges, the pros and the cons behind their digital transformation - in the limit, algorithmization. By leveraging SW's suite of products, beyond mere Power Point slides, an impactful, hands-on experience can be granted. E.g. risk managers become more confident and challenging at meetings with algorithmic traders once they boost their experience through SW's prized VR SANDBOX ®.

SW's courses are modular to ensure and ad-hoc itinerary and they are also affordable, so that this knowledge can be widely democratized across the firm.

· REGULATORS ALGORITHMS APPROVALS ·

Both, Regulators and Banks, approach us to better analyse the suitability of a new, more data-driven algorithm, in the decision making process related to retail.

· GREEN ASSETS SYNTHETIC LIQUIDITY ·

By managing risk systematically and intradaily volume of certain illiquid assets can be increased by more than 30%

· CRYPTO INFLUENCERS ·

Detection and analyses of different bots at Twitter that attempt to affect crypto prices

· FX FIXING AND EQUITY CLOSE PREDICTION ·

Intraday forecasts to help derivative traders better manage their risks

· FIXED INCOME ISSUANCE ·

StatArb strategies and portfolio rebalancing around auction dates

· REGULATORY ANALYSIS OF HFT ·

Distinguishing good from bad High Frequency Trading to avoid market manipulation

· ANTIMANIPULATION OF STRATEGIES ·

Make sure you are trading the strategy you are expecting to trade. All of its components. One of the few cases where we believe Blockchain has an edge.

· ANOMALY DETECTION ·

Outlier detection of standard activity across servers using billions of rows of information (Netflow data). Improvements in false positive detection exceeded x2

· CODE BOOST ·

Analysis of legacy code, redesign and strategic implementation - from data model to advanced use cases. Efficiency exceeded x3

· HOSTILE BID ANALYSIS ·

Analysis of the probability of large activist funds building up sudden exposure on a client's stock

· CEO PERFORMANCE ANALYSIS ·

Defense of a CEO's performance based on market expectations - discounting market impact from large players' expectations

· TRANSFORMATION GOVERNANCE & AUDITS ·

We can set out best practices when trying to properly govern the challenge of transformation which otherwise, would be siloed around the senior management in charge, without letting the rest of senior managers or board members challenge her decisions. Our approach and views around the "Digital (Des)Economy" has grabbed the headlines and have been the focus of several Digital Economy events.

What is the tech quality of the company a buyer is considering? Once bought, how many paths does it have to boost its digitization? What can be achieved if each of those paths were deployed?

Most M&A due diligence are missing this crucial dimension in the digital era.

SW partners up with M&A consultancies to analyze any company's technology (software and hardware architecture) towards its digitization.

It can test how difficult it would be for it to onboard a non-invasive middle ware software to leverage data and Machine Learning - analysis based on bespoke adaptions of Himitsu Tech.

And it can further advice on the pros and the cons of the current team and managers skills, as well as on its personas' conflicts of interest (Game Theory).

web page was made with Mobirise template