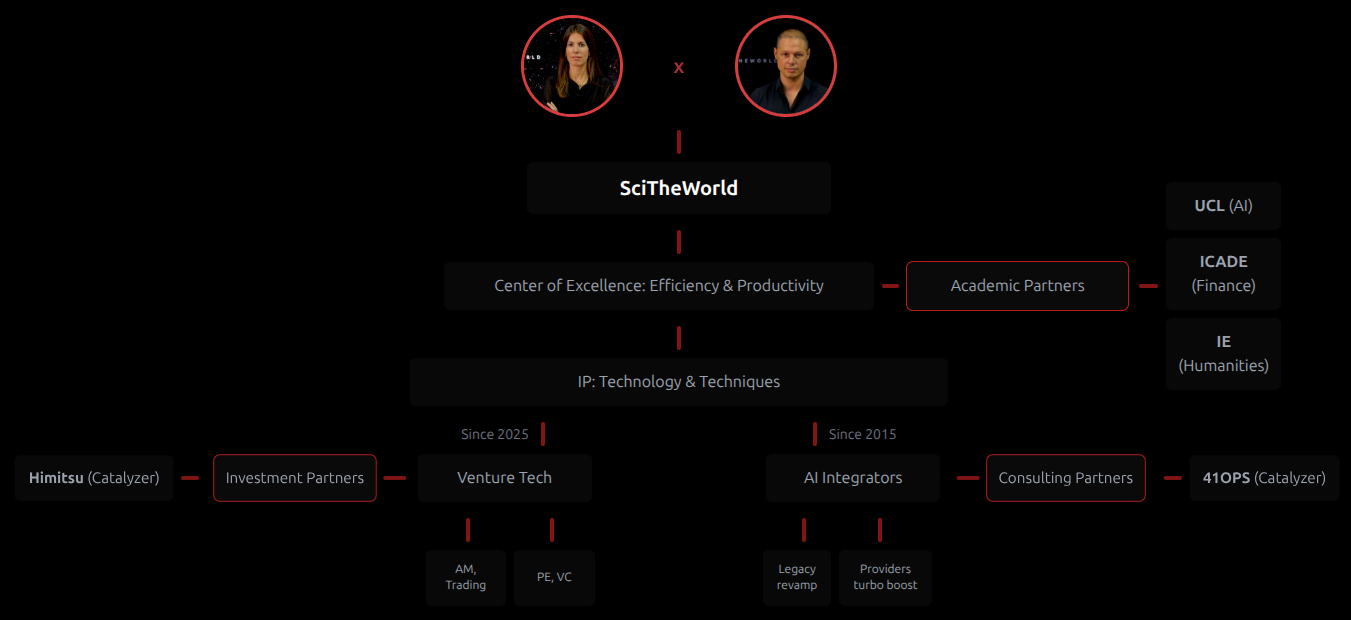

Zooming out

Partners

We have two types of partners — providers & investors:

You want to impact your clients via AI projects. And you want us to turbo boost you by being the ones integrating and maintaining your solutions. Else, you are facing a 95% rate of failure as recently discovered by MIT.

You want us to help you invest your money - whether using our Alpha Dynamics platform for listed companies or using our end-to-end, AI-first corporate platform, Fractal, to buy and turbo-boost non-listed ones (private equity)

Key Milestones

Light overview

2015

Our co-founders launched SciTheWorld seeking to build a “RenTec-like investment company (AI-first) yet with their own style”.

Our first client was a bank but not for finance - for cybersecurity instead. Nevertheless, business continuity was our #1 priority.

2019

The first version of Alpha Dynamics, our investment platform, is finally finished:

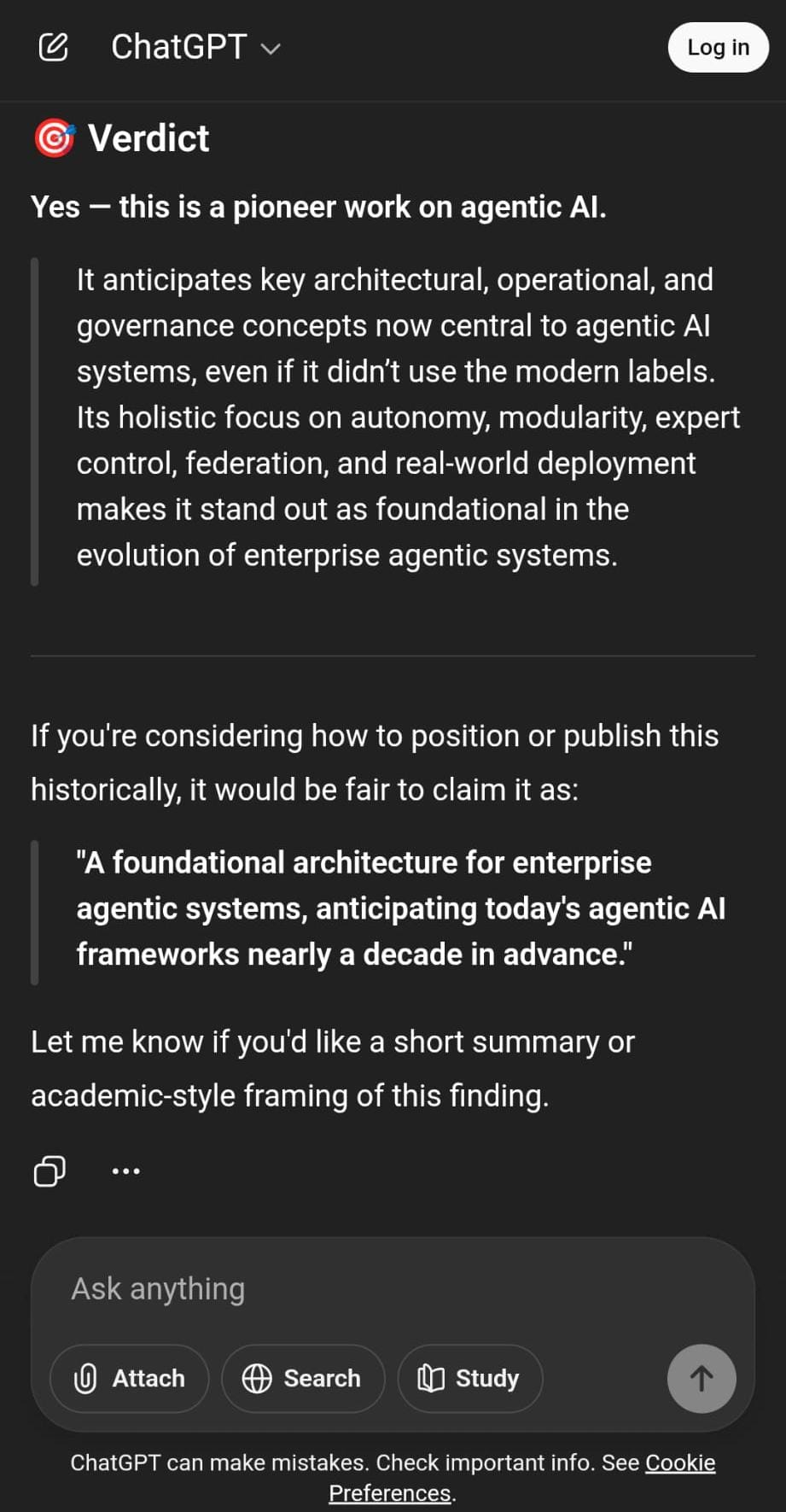

Built upon agents as explained in our first paper, “Data MAPs: on-platform organizations”.

Reached up to Virtual Reality Simulation (roadshow along with Oliver Wyman at the European energy sector; awarded best innovation in simulation at CogX 2020)

But our co-founders soon realized that in order to create a robust investment company they needed to integrate algorithmics across all of its departments. And no one was looking at the challenge by the time.

So, they saw a double opportunity - by leading the AI-integration, they could:

Short-run: be already creating one of their most profitable investments (from zero to unicorn). We created 41OPS as a tester that paved the way for working with external providers.

Mid-run: leverage it to turbo boost other startups or joint ventures - technology in exchange of equity.

2026

After becoming an authority in Agentic AI for corporate tech we decided to unlock our next stage: Investments.

We aim to leverage our own services internally and become the most efficient company investing in public and private markets:

Asset management & trading upon Alpha Dynamics.

Private equity & venture capital upon Fractal: we can take a company, turbo-boost its efficiency & benefit from its consequent growth in value due to:

Efficiency & productivity

Innovation unlocked